- HEDGE FUNDS

- ASSET MANAGERS

- HNWI

- FINANCIAL INSTITUTIONS

- FAMILY OFFICES

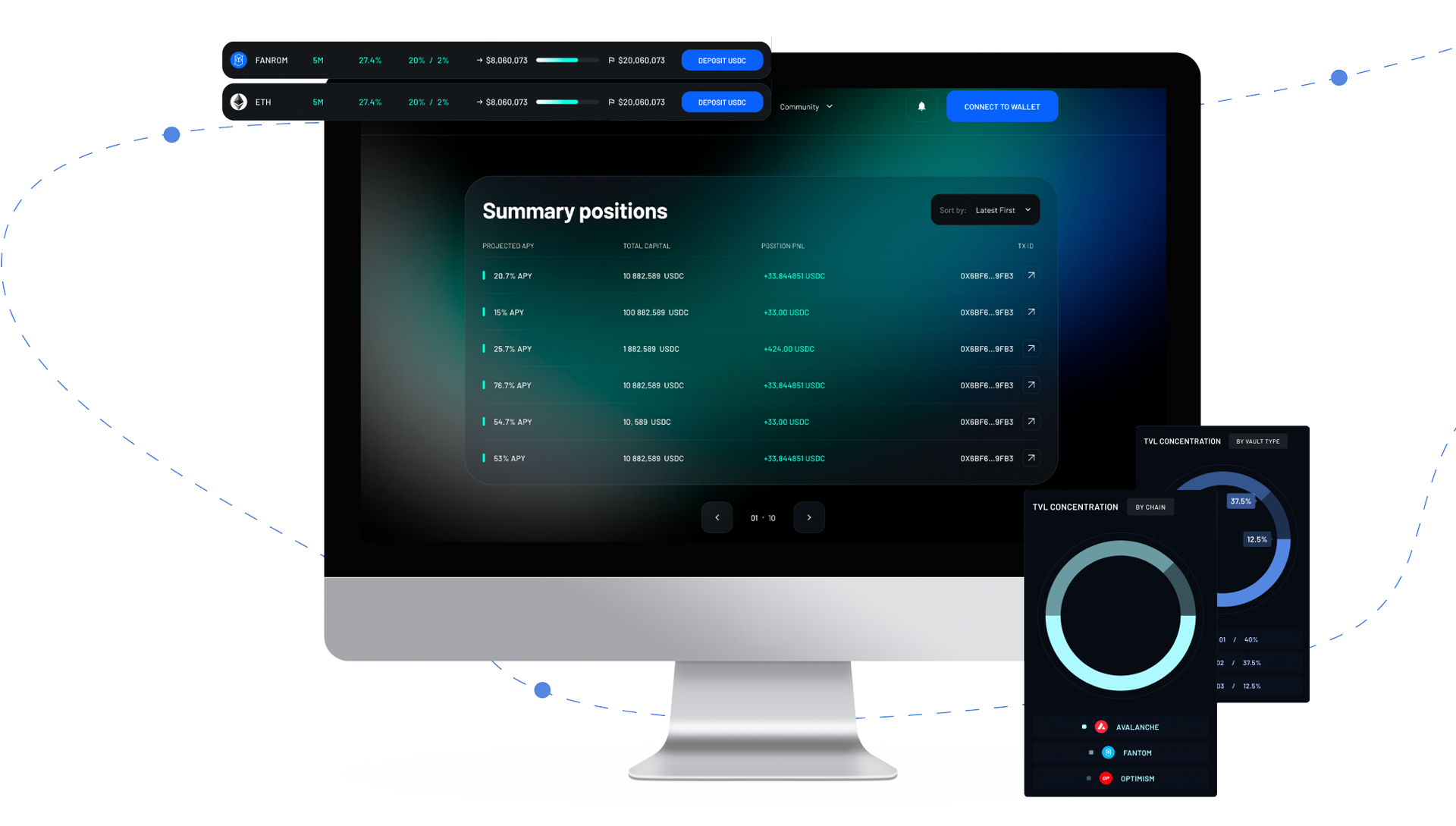

The Gateway for Institutional DeFi Asset Management

On-chain asset management tools for Institutional investors to automate the process of finding, monitoring, and consolidating yield opportunities within DeFi

Enter App

The platform for

Abstracting Complexity

Access complex and automated investment strategies and portfolios in DeFi

Our end to end solution provides a comprehensive suite of tools and services that enable Institutional investors to obtain superior yields and manage their investments in an automated way. Strategy backtesting, optimal portfolio vaults, automated rebalances, automated liquidity management, automated debt management and risk management, among others.

Check out our documentationWith DeFi Blue, Institutional Investors Can

Choose the assets you want to have exposure to

Access our library of backtested strategies

Design portfolios based on their risk/return profile

Spin-out on-chain portfolio vaults that are accessible only to them and/or their clients

Manage their investments through our self-custody governance interface

Get all the data they need for internal / client reporting through our Data API Services

Access to real time dashboards of their portfolios and underlying components

Manage Risk with the DeFi Blue Risk Management Operations System

DeFi Blue Platform Components

Back Testing Environment

We spent a considerable amount of time building an environment to perform thorough back testing analysis using historic data. We are modularizing the back test environment to allow easy combination of functions such as leveraged liquidity provisioning, delta rebalancing, etc. We also have an on-chain simulation module that help our team test the strategies’ performance and behaviour as if they were live on-chain.

Yield Strategies

Our quantitative research team models, tests and designs composable yield strategies using most of on-chain DeFi primitives such as liquidity provisioning, staking, lending and prime brokerage (leverage borrowing). These strategies involve the integration with a series of pre-vetted DeFi protocols across different blockchains that are composed together programmatically.

Optimisation Engine

We developed a series of tools to optimize our strategies and maximise risk adjusted returns

- •Automated liquidity range management for UniswapV3

- •Impermanent loss hedging

- •Optimal portfolio allocation for vaults with combined strategies

- • Automated yield harvesting and compounding

Vault Infrastructure

All our strategies are deployed on our vaults, which are permissionless smart contracts that can be accessed using self-custodial wallets such as Metamask and Wallet Connect. Our clients can define the strategies they want and deploy their private vaults where only whitelisted addresses can deposit and withdrawal funds.

Embedded Risk Management Engine

DeFi Blue has an embedded risk management engine that monitors every aspect of how the platform functions. The risk engine tracks hundreds of data points on our strategies, assets, integrated protocols and blockchains and has an alert system that executes multiple procedural protocols based on the urgency and severity of the situation.

Shaping the Future of DeFi Asset Management

Multichain

Targeting the most relevant and reputable blockchains and ecosystems with significant DeFi potential

Composable

Quantitative driven yield strategies using pre-vetted DeFi protocols. Ability to create custom portfolios containing multiple yield strategies

Programable and Automated Vaults

Our smart contract vaults allow, among other things: Automatic harvesting and compounding, Liquidity range optimisation (for Uniswap v3), automatic Rebalancing, Portfolio optimisation.

Risk Managed

Embedded risk management engine that controls the functioning of the platform. Risk committee that reviews risk metrics

Securely Managed

Audited smart contracts by Hacken

Self Custody – our platform is non custodial so your funds are always at your disposal

Easy to Use & Transparent

Striving to provide the best user experience with one-click investments and withdrawals, real time analytics and dashboards, API data services

A Founding Team with Strong Experience and Track Record

Diego Lijtmaer

CEO/Co-founder

Diego Lijtmaer is an entrepreneur, tech executive and investor. His professional career spans start-ups, scale-ups and large global enterprises in a variety of leadership roles across different industries such as finance, consumer tech, e-commerce and web 3. Following his MBA at Wharton, He started his career in finance as a FIG Investment Banker for UBS Bank in London, where he advised Governments, banks and insurance companies during the 2008 financial crisis. Diego was also part of the Executive team for Just Eat Plc, where he led the business development and last mile logistics functions. He has also successfully co-founded companies in different sectors such as web 3, technology, financial services and hospitality.

José García

CTO/Co-founder

Jose has 17 years of experience building technology. He began his career working at Unico Inc., developing tech for the industrial automation sector where he found his passion for product development. As an entrepreneur he started and sold TecnoJAR, an industrial automation company, to Regal Beloit Corp, co-founded Eprezto and Moveo Ventures to invest and develop technology that advances the financial industry in Latam. For the last 4 years he has been focused on blockchain and building technology for the financial industry. He holds a degree in Mechatronics Engineering from Monterrey Tec and an MBA from EGADE Business School.

Powered By a Growing DeFi Ecosystem

Contact Us